OPINION: Cooking the Books – Land misstated by IVGID for over a decade

Organizations “cook the books” when they use accounting schemes and tricks to falsify their financial statements (i.e., their books) to make their results appear better than they actually are. One of the ten most common schemes: “Improper capitalization of expenses occurs when a company capitalizes current costs that do not benefit future periods. By doing so, a company will understate its expenses in the period and overstate net income. The most well-known example of this scheme involved WorldCom, in which the company overstated its net income by more than $9 billion by, among other accounting tricks, improperly capitalizing operating expenses.” (National Law Review: https://www.natlawreview.com/article/top-10-ways-companies-cook-books )

And improper capitalization of expenses is exactly what the Incline Village General Improvement District (IVGID) appears to be doing. For over a decade. Our first example is Land, specifically Land in the Community Services Fund. In a future article, we will examine a recent example of improper capitalization of costs for capital projects.

Knowledgeable residents know that IVGID has not acquired any substantial amount of land in the last 12 years – the 89 parcels received from Washoe County in 2013 dedicated to open space were mostly tiny postage stamp lots. So how could Land in the Community Services Fund increase from $1,041,043 (2009) to $12,315,573 (2022)?

Examining the details of the Fixed Asset Ledger (FA Ledger) provides the answer. Former Directors of Finance Ramona Cruz (~FY2002 – FY2011) and later Gerry Eick (FY2012-FY2019) capitalized millions of dollars of stream restoration costs. These costs should have been expensed. Capitalizing these costs meant IVGID overstated its net income and fund balances, painting a much rosier picture than the reality.

Improper Capitalization

How do we know the costs for stream restoration should have been expensed?

First, stream restoration costs don’t extend the useful life of the land. The area around the streams restored – usually the golf courses – operated the same before the restoration as after. That is true for erosion control and TRPA mandated “BMPs”. These expenditures should be expensed, not capitalized.

Second, look at other local governments. We looked at Alameda County, the City of Mission Viejo (California), the town of North Carolina; all expensed such costs. “The Oso Creek Restoration project was recorded as complete in FY 2013-14 and costs incurred over the life of this project in the amount of $0.9 million, that were not eligible for capitalization, [emphasis added] were recorded in the Infrastructure Maintenance program area.” (City of Mission Viejo: CAFR 063014 with cover.pdf) The North Carolina local governments often use a separate fund for stream/creek remediation costs. This provides transparency.

[updated Feb 6, 2024] We emailed County of Alameda to ask their reasoning for not capitalizing the stream restoration costs. Their Assistant Controller, Mr. Yankee, responded, “This asset is land, which has no useful life, so it is not capitalized. Restoration is restoring the asset to its original condition, which is maintenance work.” (email Oct 24, 2023) We can’t put it any plainer than that.

|

|

|

Third: Just because an auditor gives a “clean opinion” does not mean an accounting approach was correct. Arthur Anderson was the auditor for both Worldcom and Enron. The lawsuits for financial statement fraud resulted in bankruptcy of Arthur Anderson, as well as WorldCom and Enron.

Fourth: This is not the first time IVGID has been accused of improper capitalization of costs. In 2021, Moss Adams was hired by IVGID Board to examine whether improper capitalization of capital project costs was occurring; Moss Adams said yes. “The District has been capitalizing expenditures incurred in the development of master plans as well as costs incurred that do not relate to specific capital projects or that increase the service capacity of an existing capital asset. This is not in compliance with established governmental accounting practices. In addition. the Board’s capitalization policies and practices are not sufficiently detailed to provide guidance on what types of costs should be considered for capitalization.” (link: Moss Adams Report, page 4)

How much Community Services Fund Land does IVGID own?

So how much Land is really in the Community Service Fund? And does the detail FA Ledger contain the expected entries? (spoiler alert: the answer is no. If you want to skip the gory accounting details, skip to the next paragraph: Were these acts intentional?)

Per Washoe County records, IVGID owns 151 parcels (~1,513 acres). The FA Ledger contains only 34 parcels, and 97 other entries of capitalized costs. (Link: Page 1 Page 2). NOTE: The graphics are extracts from IVGID’s FA Ledger, with our editor notes. IVGID uses the term “SERIAL#” rather than “PARCEL#”.

We examined the audited financial statements from 2009 – 2022. The LAND account has been incorrect since 2009, and likely before this time. The Community Services Fund, Land (2009) included only 4 parcels for a total of $1,041,043 [graphic]. The “COMMERCIAL LOT” is questionable – the ski resort was one parcel, so why is a commercial parcel listed under Diamond Peak? Could this be the bowling alley acquired as part of the purchase from Japan Golf – and that was sold in 1978?

In FY2010, TWO parcels were added to the Community Services Fund: IV Park Area (948 Incline Way – Parasol Building) and the Incline Lake parcel. These should have been included in FY2009 – but were missed. And 49 items of expenses totalling $1,907,810.54 were included (pink). These costs were not even from the current year and yet they were capitalized! This is wrong. A majority of these expenses were for Diamond Peak, about half of which is leased Forest Service land. (Link: 49 items of expenses detail)

The FY2010 CAFR and FA Ledger did not include the 4 parcels below that were dedicated to recreation. Our estimated Fair Market Value at date of acquisition totals $5,396,192. (Link: All parcels in Washoe County records Page 1 Page 2

From FY2011 – FY2017, IVGID capitalized stream restoration costs of $8,983,657.77 (pink), but this was improper. CAFR 2020 shows land in Community Services Fund as $11,996,998.80,

ACFR 2022

In FY2020, IVGID capitalized $318,574.72, increasing the LAND – Community Services Fund account to $12,315,573 (ACFR 2022, page 36). The journal description was “Fixed asset made in use: 11451” – but these are costs for a capital project – not land acquisition – and should NOT be part of the land account. These costs should have been expensed.

Were these acts intentional?

In its Oct 5,2023 presentation, auditor Jennifer Farr stated, “The distinguishing factor between fraud and error is whether the underlying action that results in the misstatement of financial statements is intentional or unintentional.”

Now – have these misstatements been intentional?

1. The FA Ledger appears to have been prepared so it would tie with the Financial Statements, rather than to include the land IVGID owned. Google Map of IVGID Parcels

Forty-nine items were added to the FA Ledger with dates between 1986 and 2003. But these ledger items were included in the FY2010 Community Services Fund LAND balance – but NOT in the FY2009 balance. That makes no sense from a proper accounting perspective. To capitalize these past costs is deceptive.

2. Professional due care appears to be lacking in the preparation of the FA Ledger. Over 110 parcels are not in the Ledger. Parcel Numbers are sometimes invalid, meaning there is no parcel in Washoe County records for that parcel number. No acreage is listed. Descriptions are vague and often do not include sufficient information to correctly identify the parcel. And is the cost accurate? Cost has been allocated between land and buildings, but no detail calculations have been provided. The purchase of the Champ Golf Course included a 2.1 acre lot next to the driving range ($150,000), so how can the cost of both golf courses be the same? (Link: Page 1 Page 2).

3. Costs have been intentionally capitalized. Stream restoration costs are the largest component, but costs for erosion control, TRPA inspections and “BMPS” were also capitalized. Capitalization of these costs is improper as the costs did not increase the service life of the asset.

To understand what might have motivated these actions, consider these facts. Prior to 2015, employees received a bonus based on financial results of IVGID. Thus, by understating expenses, financial results appears better than actual. In 2013 and 2014, a total of $1.4 million dollars in bonuses was paid to employees. These bonuses were not approved by the Board of Trustees. Gerald Eick received $22,524.29 (2013) and $14,710.85 (2014). In 2015, then General Manager Steven Pinkerton increased wage rates, and eliminated the bonus scheme.

Based on these facts, it is hard to characterize these activities as mistakes. These are intentional acts. Both Ramona Cruz and Gerald Eick were licensed CPAs. Former Controller Lori Pommerenck was a CPA, though not licensed.

Conclusions

We believe the improper capitalizing of expenses and misstatement of the Land asset category in the financial statements is fraud, as intent is evident.

And the differences in amounts are “material”. Land has been misstated on the financial statements for the Community Services Fund category from FY2010 – present, and expenses have been understated by an estimated $8.98 million dollars. The financial statements must be restated to accurately reflect IVGID’s assets.

Anyone who has stated that there has been no evidence of fraud at IVGID should read this article and examine the facts and evidence, which we believe is clear and convincing. The Board of Trustees should determine – in writing – whether fraud is covered by IVGID’s insurance, and whether damages are recoverable. Here is a question they should ask: Would insurance coverage and recovery of damages include the need for a forensic audit and its costs?

The Board of Trustees has authorized a forensic audit, which is in the Request for Proposal stage. We will be making our research available to the audit firm. And watching closely to see what is done with it.

This article contains allegations and the defendant is presumed innocent until and unless proven guilty in a court of law.

(UPDATE Oct 20, 2023 Today we obtained audited financial statements back to Fiscal Year 1990 for IVGID. A preliminary review reveals the fraud explained here has been ongoing since 1990, and likely before that time. We will be documenting our findings, and providing them to the Board and the forensic auditor. )

The author, J. Gumz, is a long-time resident and property owner of Incline Village and a registered voter. Cliff Dobler, a long-time resident, owner, and voter of Incline Village, contributed to this article. Both were CPAs, now retired.

WOW, incredible article, thank you for your efforts to try and bottom out what has transpired!

Thank you so much for all the valuable and true information. Clearly those who support the recall will not read this as it does not fit their agenda or narrative.

It would be great information to pass out at the next board meeting.

Nothing to do with the recall. They failed the community to the point a recall has been initiated. Right now a brand new addition to the Rec center would be underway if it weren’t for at least one of the individuals on the recall list.

Your statements are not based in reality. Mr. Duffield got his TRPA permit and realized he could build his own gym. For the facts, read https://ourivcbvoice.com/rec-center-expansion-project/

You are aware that his place is a temporary building and up for two years only? You should check the permit.

Let’s see the permit. You apparently have a copy. Forward to Cliff Dobler @ cfdobler@aol.com

Wrong. The permit to build had a 2-year limit, not the structure itself. The construction is complete and the building is in use.

Thank you for your comment.

Washoe County says the Grade of the building is C25 Commercial 2.5 (Above Average). https://www.washoecounty.gov/assessor/cama/?parid=13030226

This is not a temporary building, Special “gluelam” beams were used in the construction. Photos are provided in the article on our site.

You can CLICK the PERMIT in BLUE in the link to see permit details.

PERMIT NEW 60 X 80 GYMNASTICS GYMNASIUM TO INCLUDE RESTROOMS / NO SPECTATOR SEATING / ASSOCIATED GRADING; CIVIL SITE AND UTILITY IMPROVEMENTS / **8/25/22 REVISED BUILDING SIZE OF 60 X 78′-9? **

@ KW – IVGID has capital funds to fund enhancements to the Rec Center. If enhancements or further development to the Rec Center is *so* needed by the community, why isn’t the community demanding it as a key community priority? Instead, the community dropped the Rec Center like a hot potato to chase new shiny objects, like a dog park and beach building and golf tee times for subsets of community members.

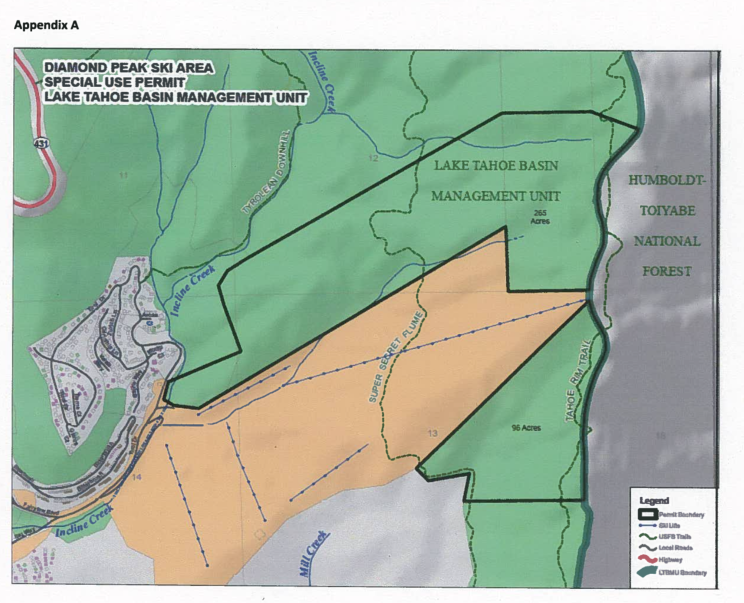

As the former Mountain Manager for Diamond Peak when we did the expansion, I need to set the record straight. When we did the expansion we only leased a small amount of land from the Forest Service. The majority of Diamond Peak is privately owned by IVGID. Thanks for keeping us informed…

Respectfully, we disagree. The amount of land is about half-half in terms of acreage.

IVGID’s parcel is 367.33 acres. (tan parcel in graphic) The USFS lease is 265 + 96 acres = 361 acres. The leased area of both parcels (green) is shown in this graphic from the USFS Ski lease.

Amazing that one can so easily capitalize expenses to jack up the profits. My manufacturing company could never get away with such accounting tricks.

I note among the land holdings that there is one parcel that IVGID should sell and convert to cash.

Note that parcel 12650001 is a lot in Tyrolian Village HOA that is close to the street and not overly difficult to build on and has empty Forest Service lots on three sides.

IVGID received this lot from the County.

The HOA is losing HOA fee’s from this lot and the County is not getting any property taxes and IVGID not getting a rec fee. I wonder if anyone in IVGID is getting to use the beach access?

The lot probably has a market value of $100k+. A sale would be in the interest of all; HOA, IVGID, County, local brokers, and potential home owners.

I asked IVGID to contact a broker and simply sell the lot. So far I have heard zip from them.

With the update to NRS 318 after Dir of Finance Gerald Eick sold 3 lots without Board approval, the Board has to follow certain processes in selling land. Appraisal is required, for example.

But your point about the lot being sold makes sense. This has to be done transparently. The lot may be worth much more than $100K.

Pingback:OPINION: Cooking the Books – Part 2 – Our Incline Village Crystal Bay Voice

Pingback:Forensic Audit: The need to investigate accounting fraud by past IVGID management – Our Incline Village Crystal Bay Voice

Pingback:OPINION: Cooking the Books – Part 3 – Our Incline Village Crystal Bay Voice

Pingback:IVGID’s Financial Meltdown – Part 2 – Our Incline Village Crystal Bay Voice