General Fund 2017-2020

Posts

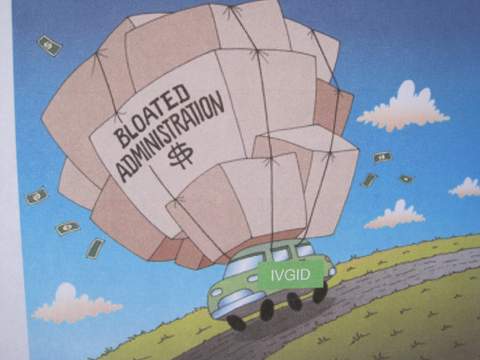

The General Fund: Accounting Magic to pay for the District’s Bloated Bureaucracy

A considerable amount of time is spent on the Recreational Venues and Utilities but not much is said about the rising costs of District-wide administration. These costs are accounted for in the General Fund. The top brass is paid out of the Fund.

In fiscal year 2014 expenditures for the General Fund were $3,196,000. The budget for fiscal year 2018 is now $4,206,000. This four year increase of $1,010,000 or 31.6% has happened since GM Pinkerton arrived. Over 65% of the spending is for salaries and benefits.

In 2014, there were 28 full time equivalent employees (FTE). In 2018 there will be 40. This is a 43% increase despite a stagnant community population and no new venues to administer. For comparison during the same period, the Utility Department added only 2.6 FTE, going from 32 to 34.6 employees . ALL of the recreational venues added only 7 FTE going from 178 to 185 FTE.

Are you getting the picture where the money is going? A big increase in office staff and only minimal additional on-site staff to maintain and improve services.

The only main revenues to pay for these costs come from Ad valorem Taxes (property taxes) and a share of Consolidated and Sales Taxes received from the County and State. The annual Recreation Fee cannot be used to pay for General Fund expenditures (Ha Ha). The 2018 Budget estimates only $3,168,000 will come from these taxes which is a 20.2% increase since 2014 to pay for the $4,206,000 in spending.

Does anyone notice a problem? 2018 Spending EXCEEDS revenues by over $1,100,000 and has been growing faster than tax revenues!

Are we going broke? No. The overspending is resolved by an accounting fix by our slick accountants. In order to balance the books it was decided some time ago that about $1,100,000 would be billed annually to the Community Services Recreation Venues , Beaches and Utility Funds to reimburse the General Fund for CENTRAL SERVICES COST ALLOCATIONS. If anyone is wondering why expenses seem so high in these other funds, it all in the accounting. Layer after layer of management tacked on by this sly accounting maneuver. IVGID considers these billing as Revenues in the General Fund. Just make up a bill.

Simply stated, although the District’s tax revenues have increased with the rise of assessed property values, the General Fund’s expanding work force and overall spending binge ( a bunch of legal fees) have far surpassed the increase in revenues. These “tax revenues” are fortunately capped by the State. As a consequence, increases in Utility Fees, Venue User fees, Beach Fees and soon to be Recreation Fees, which have no constraints placed on the amount the District can charge and determined solely by the IVGID Board are then used to subsidize the General Fund’s overspending.

Can everyone now see the reason why GM Pinkerton, Director of Finance Eick and Trustees Wong, Horan and Morris were pushing to have the Parasol building $5,500,000 purchase price paid by our Recreation Fees rather than the General Fund tax revenues? The General Fund would never have the money or future cash flow to support the operations and required debt service. The primary justification for the Parasol purchase was to house the 40 administrative employees.

PS: The Ad valorem property tax revenues for 2018 are based on a little less than 12 cents for every $1,000 of the assessed valuations of properties located within the District. The assessed valuations are $1.6 billion. The Board of Trustees do not have to assess any taxes but cannot assess more than the 12 cents. Historically the Board has always assessed the maximum allowed by the State.

#General

A considerable amount of time is spent on the Recreational Venues and Utilities but not much is said about the rising costs of District-wide administration. These costs are accounted for in the General Fund. The top brass is paid out of the Fund.

In fiscal year 2014 expenditures for the General Fund were $3,196,000. The budget for fiscal year 2018 is now $4,206,000. This four year increase of $1,010,000 or 31.6% has happened since GM Pinkerton arrived. Over 65% of the spending is for salaries and benefits.

In 2014, there were 28 full time equivalent employees (FTE). In 2018 there will be 40. This is a 43% increase despite a stagnant community population and no new venues to administer. For comparison during the same period, the Utility Department added only 2.6 FTE, going from 32 to 34.6 employees . ALL of the recreational venues added only 7 FTE going from 178 to 185 FTE.

Are you getting the picture where the money is going? A big increase in office staff and only minimal additional on-site staff to maintain and improve services.

The only main revenues to pay for these costs come from Ad valorem Taxes (property taxes) and a share of Consolidated and Sales Taxes received from the County and State. The annual Recreation Fee cannot be used to pay for General Fund expenditures (Ha Ha). The 2018 Budget estimates only $3,168,000 will come from these taxes which is a 20.2% increase since 2014 to pay for the $4,206,000 in spending.

Does anyone notice a problem? 2018 Spending EXCEEDS revenues by over $1,100,000 and has been growing faster than tax revenues!

Are we going broke? No. The overspending is resolved by an accounting fix by our slick accountants. In order to balance the books it was decided some time ago that about $1,100,000 would be billed annually to the Community Services Recreation Venues , Beaches and Utility Funds to reimburse the General Fund for CENTRAL SERVICES COST ALLOCATIONS. If anyone is wondering why expenses seem so high in these other funds, it all in the accounting. Layer after layer of management tacked on by this sly accounting maneuver. IVGID considers these billing as Revenues in the General Fund. Just make up a bill.

Simply stated, although the District’s tax revenues have increased with the rise of assessed property values, the General Fund’s expanding work force and overall spending binge ( a bunch of legal fees) have far surpassed the increase in revenues. These “tax revenues” are fortunately capped by the State. As a consequence, increases in Utility Fees, Venue User fees, Beach Fees and soon to be Recreation Fees, which have no constraints placed on the amount the District can charge and determined solely by the IVGID Board are then used to subsidize the General Fund’s overspending.

Can everyone now see the reason why GM Pinkerton, Director of Finance Eick and Trustees Wong, Horan and Morris were pushing to have the Parasol building $5,500,000 purchase price paid by our Recreation Fees rather than the General Fund tax revenues? The General Fund would never have the money or future cash flow to support the operations and required debt service. The primary justification for the Parasol purchase was to house the 40 administrative employees.

PS: The Ad valorem property tax revenues for 2018 are based on a little less than 12 cents for every $1,000 of the assessed valuations of properties located within the District. The assessed valuations are $1.6 billion. The Board of Trustees do not have to assess any taxes but cannot assess more than the 12 cents. Historically the Board has always assessed the maximum allowed by the State.

#General

Mar 02, 2018 10:41:00am